A Biased View of Manhattan Life Assurance

Wiki Article

Boomerbenefits Com Reviews Things To Know Before You Get This

Table of ContentsSome Ideas on Aarp Medicare Supplement Plan F You Need To KnowThe 5-Second Trick For Boomerbenefits Com ReviewsFacts About Boomerbenefits Com Reviews UncoveredThe Only Guide to Boomerbenefits Com ReviewsThe Basic Principles Of Medicare Plan G Joke Indicators on Attained Age Vs Issue Age You Should Know

This may include points like pay stubs, financial institution statements, or income tax return details. If you're enrolled in the QMB program, you'll need to reapply for it annually. This is because your income and also resources may transform from one year to the next. Your state's Medicaid office can offer you info regarding when and just how to reapply.

You can enlist in the Bonus Aid program on the SSA web site. When you're enrolled in Bonus Assistance, the SSA will certainly examine your income and also resource status annually, normally at the end of August. Based on this testimonial, your Additional Assistance benefits for the future year may remain the same, be adjusted, or be ended.

For more details regarding the QMB program in your state, call your state's Medicaid workplace. They can aid you determine if you're qualified and offer you all the information needed to use. The info on this site may aid you in making individual decisions concerning insurance coverage, but it is not planned to supply guidance regarding the acquisition or usage of any insurance or insurance items.

Aarp Medicare Supplement Plan F for Dummies

On April 1, 2016, many Iowa Medicaid programs were collaborated into one handled treatment program called IA Wellness Link. A lot of existing Medicaid members were signed up in IA Health Link on April 1, 2016, as well as a lot of new members that end up being qualified after April 1, 2016, will additionally be signed up in IA Health and wellness Link - medicare broker.

Medicaid attends to some solutions not covered under Medicare, such as dental expenditures and also some prescription medications. If your overall countable revenue or resources are greater than the QMB limits, there are other program you might receive: Clinically Clingy: Ask the DHS workplace about Clinically Needy if you have great deals of medical expenses and not nearly enough cash to pay the bills.

The Basic Principles Of Attained Age Vs Issue Age

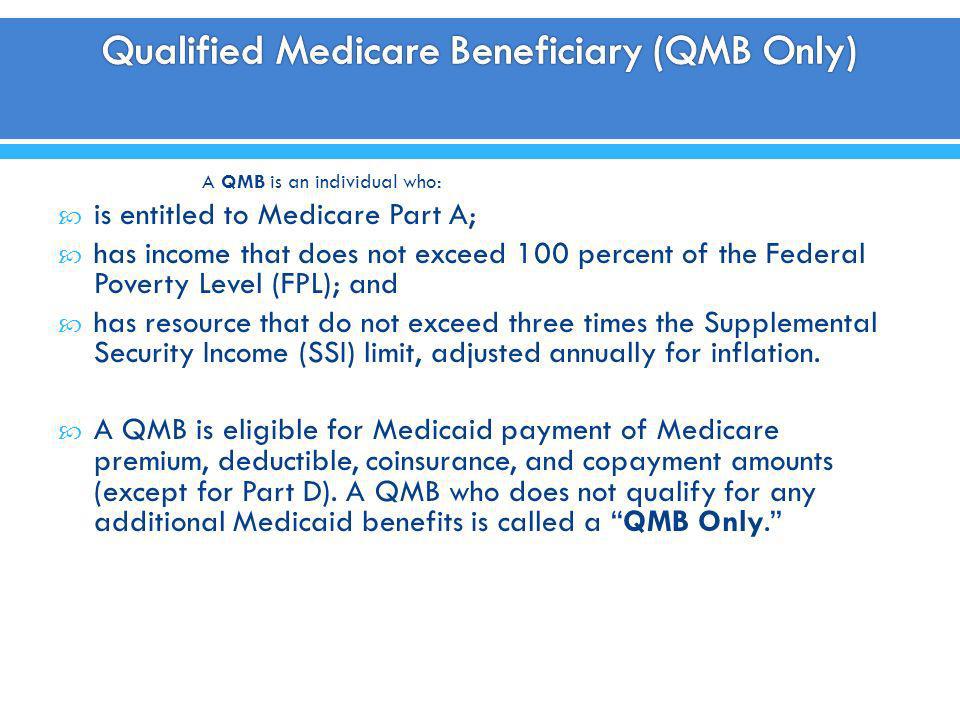

Below, we review the advantages and qualification demands of the QMB program. Next off, we take a look at the distinction between original Medicare and Medicare Advantage with respect to QMB. We look at the various other three programs that aid with Medicare prices. We may utilize a couple of terms in this piece that can be handy to understand when picking the ideal insurance policy strategy: This is a yearly quantity that a person need to invest expense within a certain amount of time before an insurance company begins to fund their treatments.For Medicare Part B, this pertains to 20%. This is a set dollar quantity that an insured individual pays when receiving certain treatments. For Medicare, this usually applies to prescription drugs. The QMB Medicare savings program can aid people with low revenue pay their Medicare prices. The QMB program is among four state-run programs that help individuals who can not afford their Medicare prices.

A person that is signed up in QMB is also enlisted in Medicaid. The QMB program spends for the following: Part A monthly costs, Part B month-to-month premiumscopaymentscoinsurancedeductibles, On top of that, QMB helps with prescription prices. The program does not allow pharmacies to charge an individual greater than $3. 90 for a prescription medication covered under Medicare Component D.The income qualification is the exact same in most states, in addition to Alaska as well as Hawaii, where they may be greater.

Excitement About Hearing Insurance For Seniors

This suggests that more than 1 in 8 Medicare beneficiaries are in the program. Whether an individual is enlisted in original Medicare or Medicare Advantage, they are qualified for QMB if they fulfill the revenue and also resource requirements.With this in mind, also if somebody assumes they might not certify for a program, they might desire to use. Below are the summaries as well as eligibility requirements of each program.

An individual has to get the QI program yearly. The program approves applications on a first-come, first-served basis, however it gives priority to a person who is already enrolled. Below are the qualification demands for income and also sources in a lot of states for QI: An individual's monthly revenue need to be under $1,456.

How Plan G Medicare can Save You Time, Stress, and Money.

An individual's sources should be under $4,000. A wedded couple's resources have to be under $6,000. Someone might quality for QDWI if among the listed below problems apply: They do not get clinical support from their state. medicare supplement plans comparison chart 2020. They are a working disabled individual under age 65. They shed premium-free Component A when they went back to work.The information on this website might help you in making personal decisions concerning insurance coverage, however it is not intended to provide suggestions regarding the acquisition or use any insurance or insurance items. Healthline Media does not negotiate the service of insurance in any kind of way and is not accredited as an insurer or producer in any kind of U.S (boomerbenefits com reviews).

Healthline Media does not suggest or endorse any kind of 3rd parties that may negotiate the organization of insurance coverage.

browse this site

Boomerbenefits Com Reviews Fundamentals Explained

Individuals or married couples must have income at or below 100% of the Federal Destitution Degree (FPL). These restrictions use to individual properties consisting of money, bank accounts, stocks as well as bonds. These limitations do not include house, cars and truck or $1,500 in funeral fund.

Report this wiki page